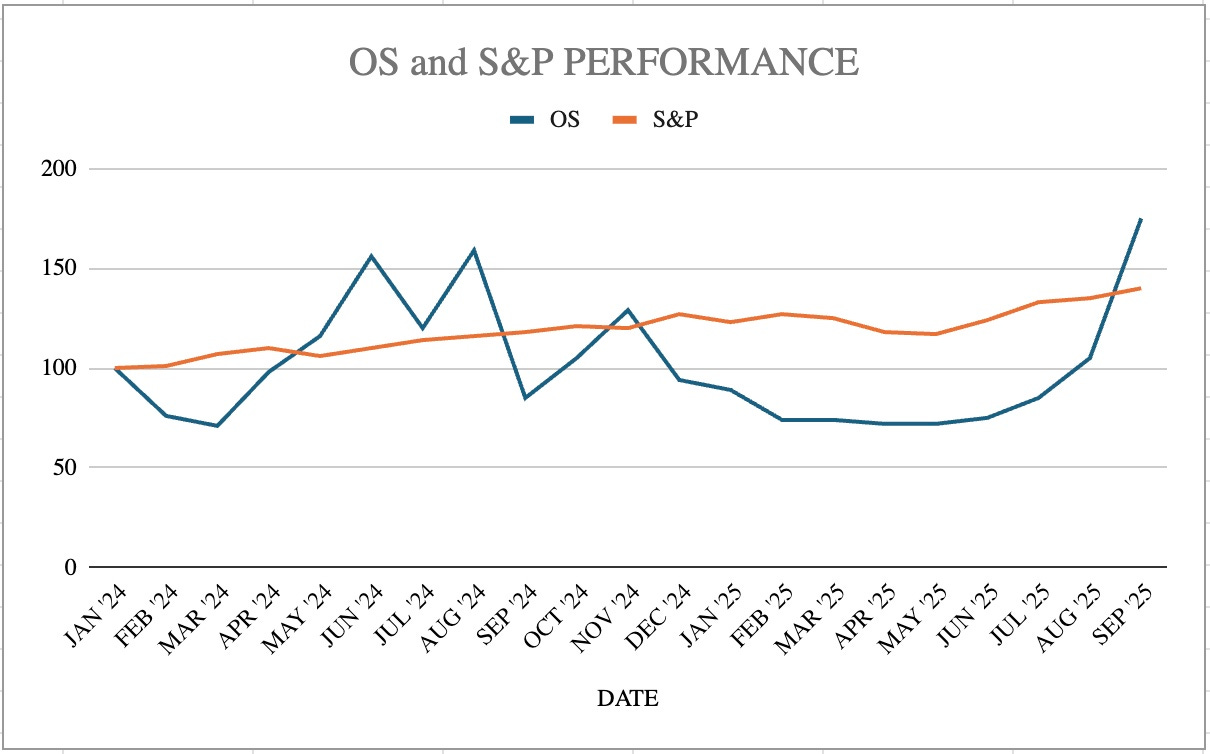

GOLD GOOD BUT SILVER BETTER - BUY THE RECENT DIP

AND OUR UPDATED O.S. vs S&P CHART (HINT: doing well)

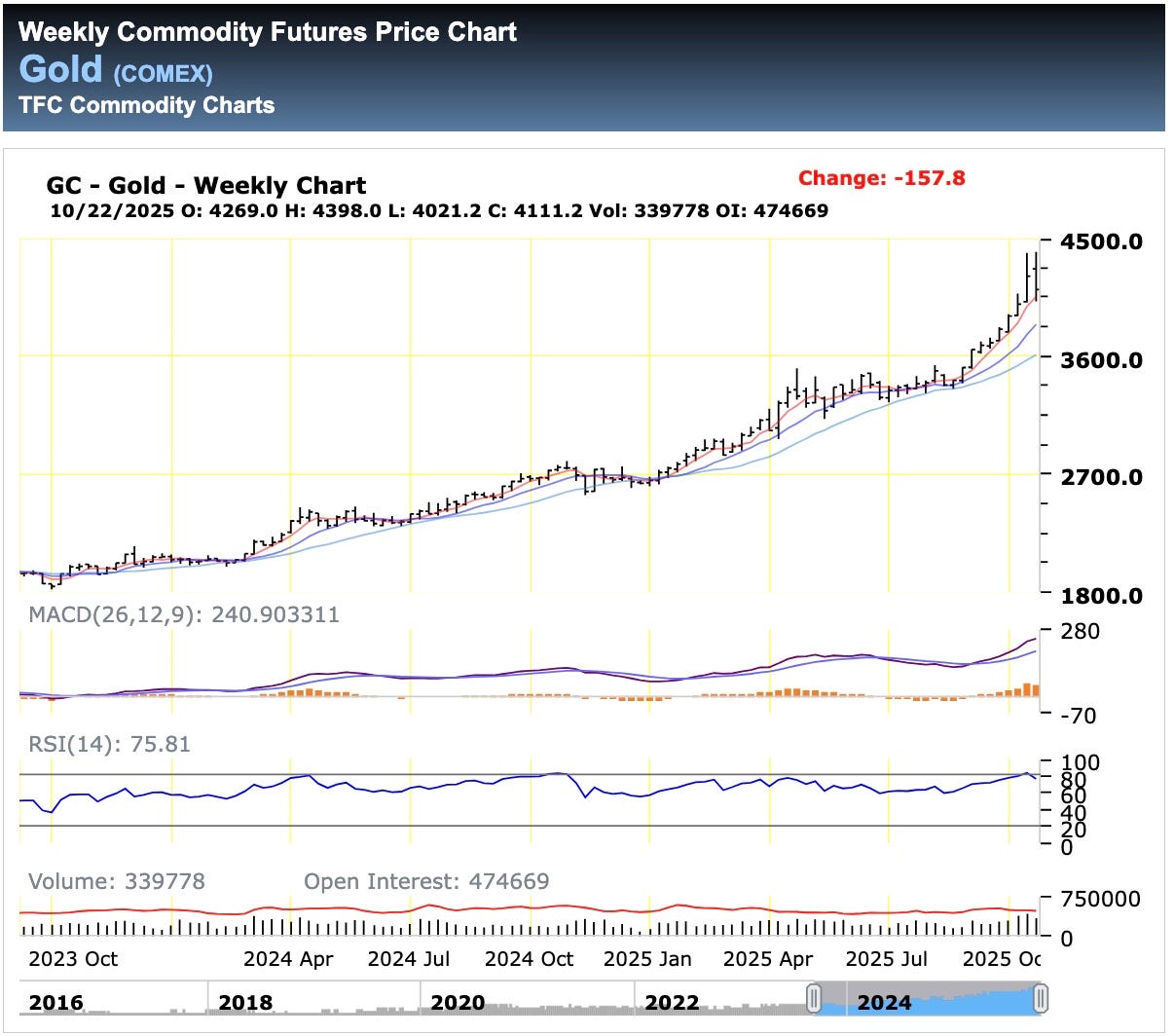

GOLD SINCE AUGUST

Since August 22nd 2025, the last plateau in gold ended and gold went vertical:

LINK to Gold: https://futures.tradingcharts.com/chart/GD/W

For literally decades most investment advisers and/or stock brokers refrained vigorously from recommending gold (or silver) be a part of an average retirement portfolio. But this vertical move in gold has at least loosened the lock of recommending only stocks and bonds but instead, according to Andy Schectman, in the US the institutional investors- FINALLY- are getting the word to put gold in the portfolio. Now, who is spreading the word?

First Morgan Stanley, who wrote that instead of the old portfolio split of 60% equities and 40% bonds, portfolios should now be 60% stocks; 20% bonds; 20% gold

Second Michael Hartnett of B of A who said your portfolio should be balanced- 25% stock, 25% bond, 25% short treasuries; 25% gold

Jeffry Gundlach, the bond king…the man who’s made his mark, his fortune- just said- a 25% allocation of gold in a portfolio is not overweight

I bet there are others now pushing gold too….

This means that the bull market in gold, which had been largely fueled by foreign investors like foreign central banks, saw that American investors for the first time in decades began to join in.

This is one of the factors convincing me that the bull market in gold has a long way to go.

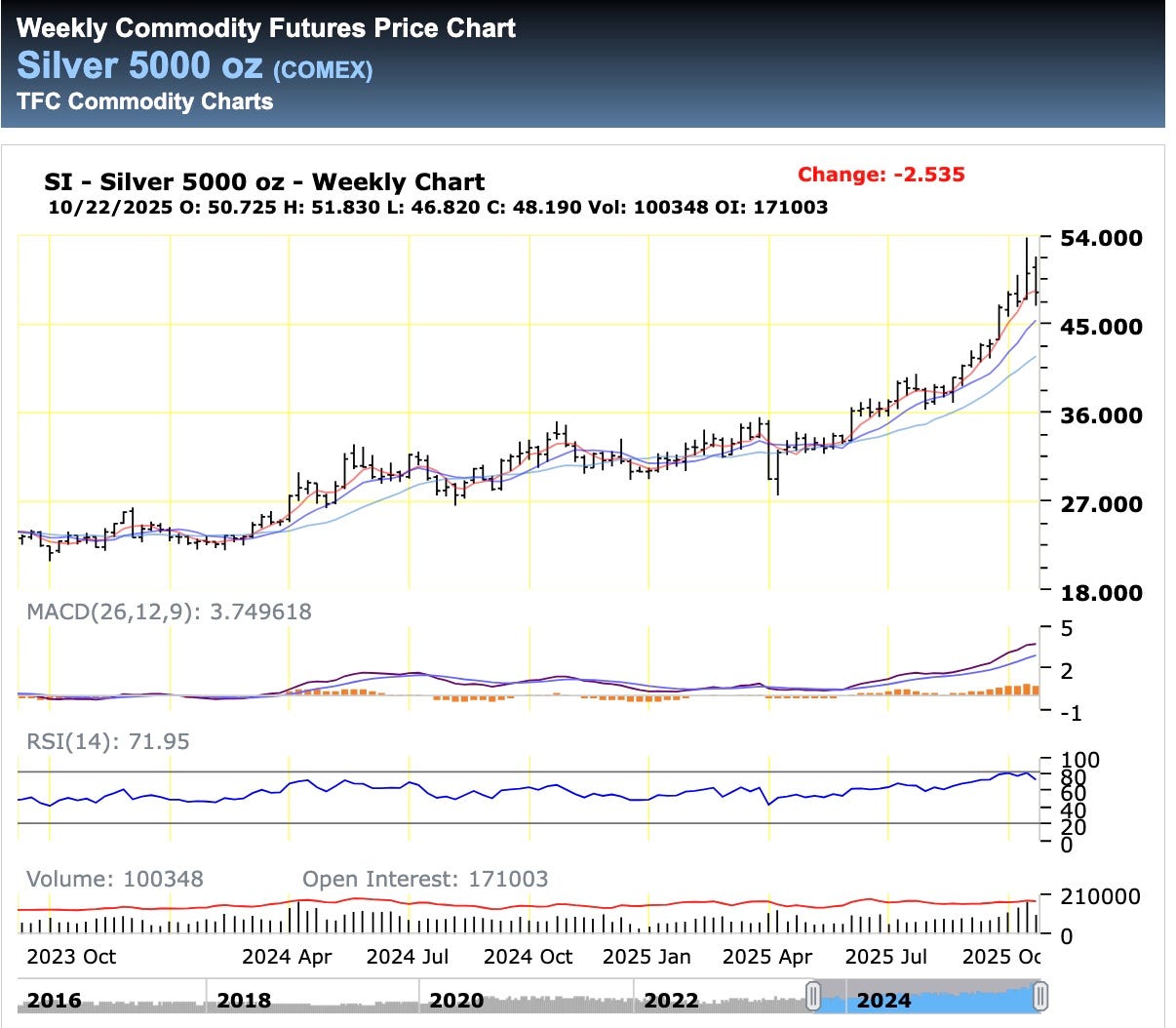

SILVER SINCE MAY

Since May 30, 2025, a different phenomenon impacted the silver market as the last plateau in silver ended and silver went vertical:

LINK to Silver: https://futures.tradingcharts.com/chart/SV/W

What was the phenomenon (SHORTAGES OF PHYSICAL SILVER) began to spread. Here are some of the best reports on the growing silver shortage...

Reported by…ALASDAIR MACLEOD ON SILVER:

Reported by…FINANCIAL WISDOM ON SILVER- SHORTAGE OF SILVER- LBMA IN TROUBLE:

Reported by…BullionIQ – CHINA SHUTS DOWN NEW SILVER TRADES- SILVER SURGING IN CHINA:

reported by…ANDY SCHECTMAN ON SILVER:

reported by GOLDMAN SACHS SAYS LEASING SILVER IN LONDON NOW COSTS A HUGE 20-30%- NO FREE FLOATING SILVER LEFT- IT TAKES FOUR WEEKS FOR THE REFINERS TO REFINE SILVER FROM Silver doré.

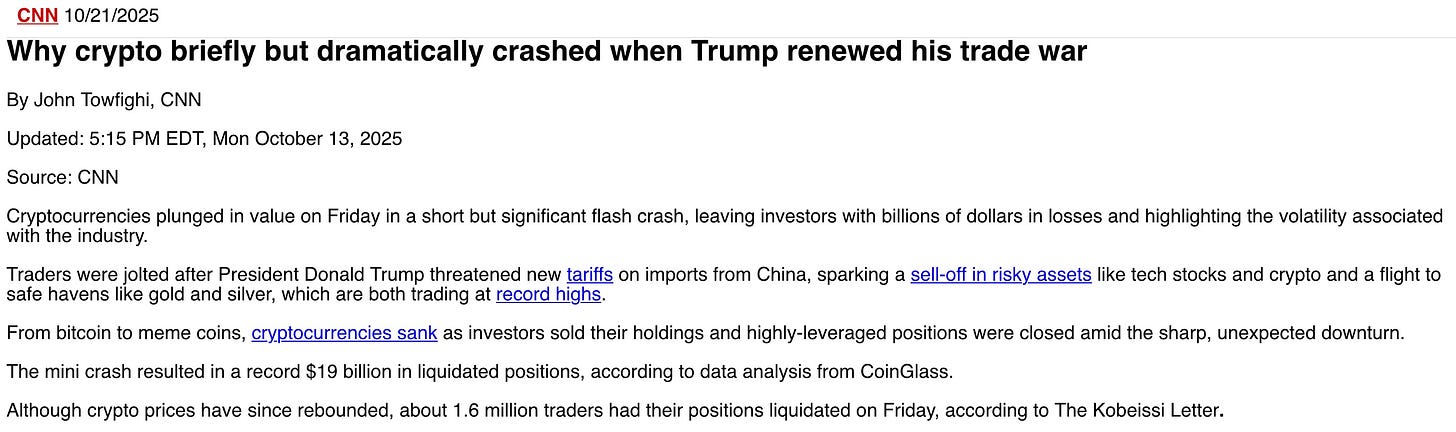

CRYPTO CRASH VICTIMS SHIFT TO GOLD AND SILVER

LINK to Crypto: https://lite.cnn.com/2025/10/13/business/crypto-bitcoin-price-drop-trump-tariffs

Some economists predict that investment demand for silver can keep rising because the non-rich who want to invest in precious metals will steer away from high priced gold for much cheaper silver. The higher silver gets, the more people will buy since it remains far cheaper than gold. This is a “Giffen Good”.

LINK to Giffen Good: https://en.wikipedia.org/wiki/Giffen_good

The growing shortages of physical silver is one of the key factors convincing me that our favorite silver miners are all STRONG BUYS : SCZMF @ $1.42; EXK @ $8.09; CDE @ $18.48; GSVRF @ $0.25.

ENDEAVOR SILVER (EXK @ $8.09) ANNOUNCES THEIR TERRONERA MINE NOW IN FULL PRODUCTION

Bullish news from Endeavor Silver- the company (finally) announced full commercial production at its critical major Terronera silver mine:

LINK to Endeavour Silver news: https://finance.yahoo.com/news/endeavour-silver-announces-commercial-production-105000101.html

this news was picked up Insider Monkey:

Link to Insider Monkey article: https://finance.yahoo.com/news/endeavour-silver-exk-jumps-fresh-141028342.html

We continue to rate EXK as a STRONG BUY in part because the recent correction among silver miners has cut EXK’s stock from its 52-week high of $10.37 to $8.10. Yahoo Finance estimates 79 cents in earnings per share for 2026- right at a P/E of 10.

SANTACRUZ SILVER’s (SCZMF @ $1.42) BOLIVIAN FOCUS JUST GOT MORE BENEFICIAL

We continue with a STRONG BUY on Santacruz Silver (SCZMF) and add even more enthusiasm both because the stock is cheaper (currently @ $1.44 down from the recent high of $2.12) and because Bolivia just elected a non-socialist President for the first time in 20 years. :-)

This is particularly good news since the company also announced important progress toward full production of their high-grade, silver-rich Soracaya project noting that their…”work at Soracaya represents a clear commitment to Santacruz’s long term growth and expansion in Bolivia.”

I conclude by reminding readers of our STRONG BUY of SCZMF has the lowest P/E with the one analyst on Yahoo Finance estimating 2025 earnings per share of 18 cents- a P/E of 8.

WHAT I LEARNED

THE RIF UNDERWAY EXPLAINED BY STEVE TURLEY- biggest impact on cutting Democrat programs like the Department of Education, EPA, DEI SPENDING, BLUE CITY INFRASTRUCTURE SPENDING:

HUGO STINNES VIDEO- the famous German industrialist who got much richer by understanding how to play the hyperinflation in Germany after World War I:

TRANS COLLEGE SUPPORT COLLAPSING:

Link to article: https://www.zerohedge.com/political/surprising-shift-transgender-bubble-pops-colleges

GAZA CEASEFIRE HOLDING SO FAR:

Link to article: https://www.timesofisrael.com/trump-floats-renewal-of-gaza-fighting-but-says-hamas-still-has-chance-to-behave/

CONCLUSION

We look on the correction in the silver miners as a chance to buy (buy this dip). Evidence of growing shortages of physical silver will fuel a further surge in the price of silver. We make no changes in our recommended portfolio from last week. Concentrating the maximum chunk of your liquid portfolio in our favorite silver miners comforts my speculative instinct- there is much more to come so consider our favorite silver miners- all STRONG BUYS : SCZMF @ $1.42; EXK @ $8.09; CDE @ $18.48; GSVRF @$0.25.

RECOMMENDED PORTFOLIO

Equities: BUY silver mining stocks: STRONG BUY on CDE @ $18.48 (way UP from last time); STRONG BUY on EXK @$8.09 (DOWN): and STRONG BUY on GSVRF @ $0.25 (DOWN); STRONG BUY on SCZMF @$1.42 (DOWN)

Equities: LONG TERM BUY on gold exploration company DC @$4.24 (DOWN)

Equities: STRONG BUY online nursing school ASPU @$0.08 (DOWN)

Commodities: SHORT Mar JGB @135.36; BUY Mar 2026 SOFR 96.47 puts; BUY Dec WTI Crude Oil @$58.28

HOLD OR SELL: HNRG, BORR, OPHC, RUM, PUMP, and RIG

PUTs on MSTR

Keep reading with a 7-day free trial

Subscribe to The Occasional Speculator to keep reading this post and get 7 days of free access to the full post archives.