SILVER- ACCELERATION AND SWITCH

NOTICE: The Subscription Fee will increase beginning in 2026; if you would like to take advantage of the low $40/year annual fee, please subscribe before the end of 2025.

To our loyal Legacy Paid Subscribers, we shall be sending our an email to all of you with a gift for your continued support. Thank you to all our readers and subscribers.

SILVER - What a Week

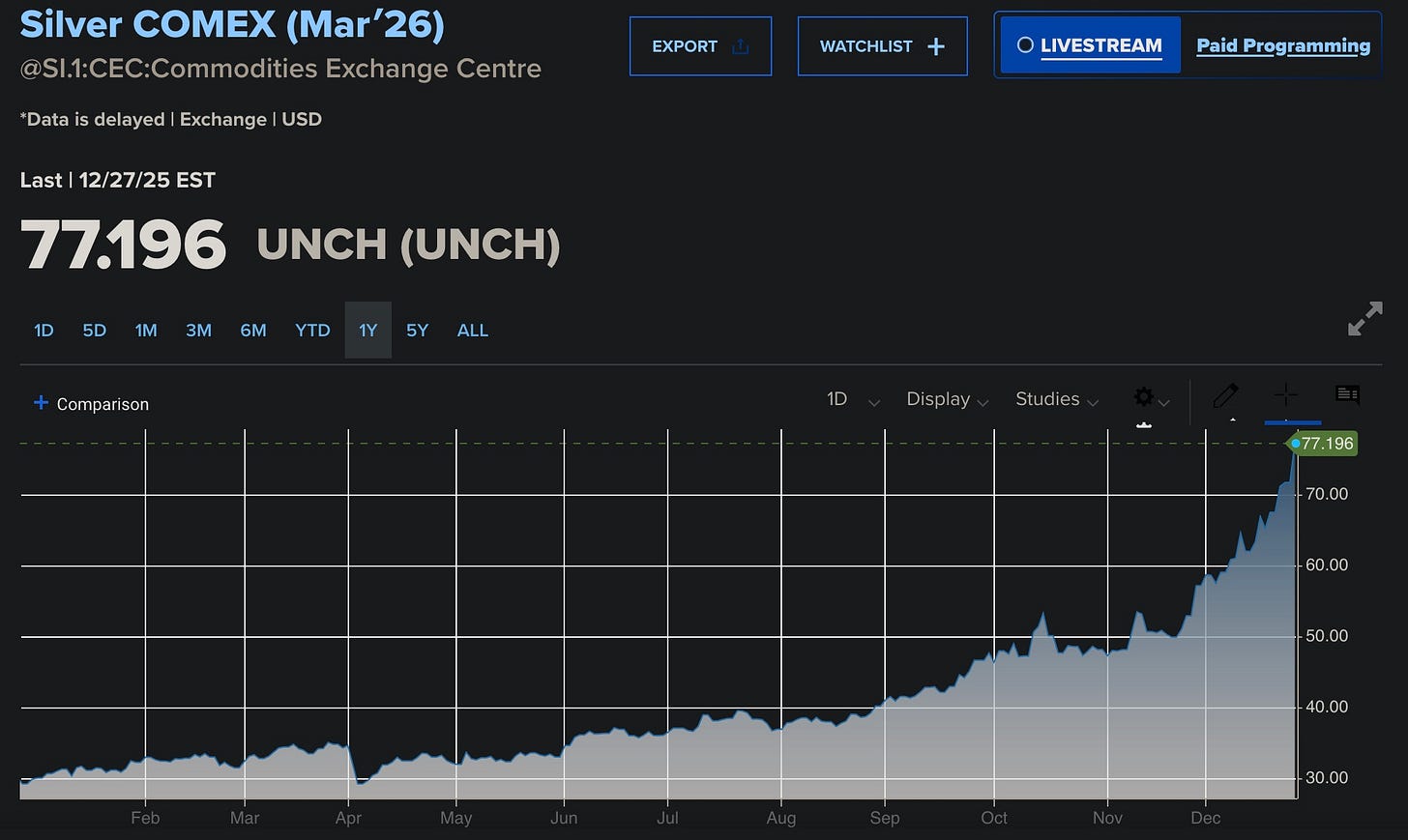

Witness the acceleration of the bull market in silver this December:

(LINK to Silver Bull Chart: https://futures.tradingcharts.com/chart/SV/M)

We have never to my knowledge had a month where the price of silver went up as much as December 2025- WOW!!!

Many investors, particularly the cautious conservative kind, are no doubt counseling taking profits off the table or in some cases sell it all.

NOT THIS SPECULATOR (once gain pounding the table). We say:

Don’t sell a share

Remember supply and demand - there is no more bullish factor than the continuing gap between demand for silver and supply of silver. A top of the silver (or any) market is unlikely until supply exceeds demand- Sure the shift from a supply deficit to a supply surplus will eventually happen when the price of silver in terms of the US dollar gets high enough which is much higher than the current $80 per ounce of silver.

Quoting Perplexity:

“Most mainstream forecasts expect silver demand to exceed supply for the rest of this decade… The Silver Institute projects another sizeable market deficit in 2025, the fifth consecutive year where demand is greater than total supply, with a shortfall on the order of 120–150 million ounces.”

A better way to decide when silver is no longer cheap is to compare it NOT to paper currency (like the US dollar) but instead compare it to real money - that is to say - GOLD. AND with cash gold at over $4500 per ounce more, AND with more analysts expecting the world to go back to the classic 15 to 1 ratio. This would mean silver is officially no longer cheap when it hits - wait for it - $300 per ounce. Meanwhile, HANG ON.

Silver now over $79 on COMEX:

(LINK to Silver COMEX Chart: https://www.cnbc.com/quotes/@SI.1)

….and $82 in Shanghai.

And the pension fund $50 Billion Wrinkle:

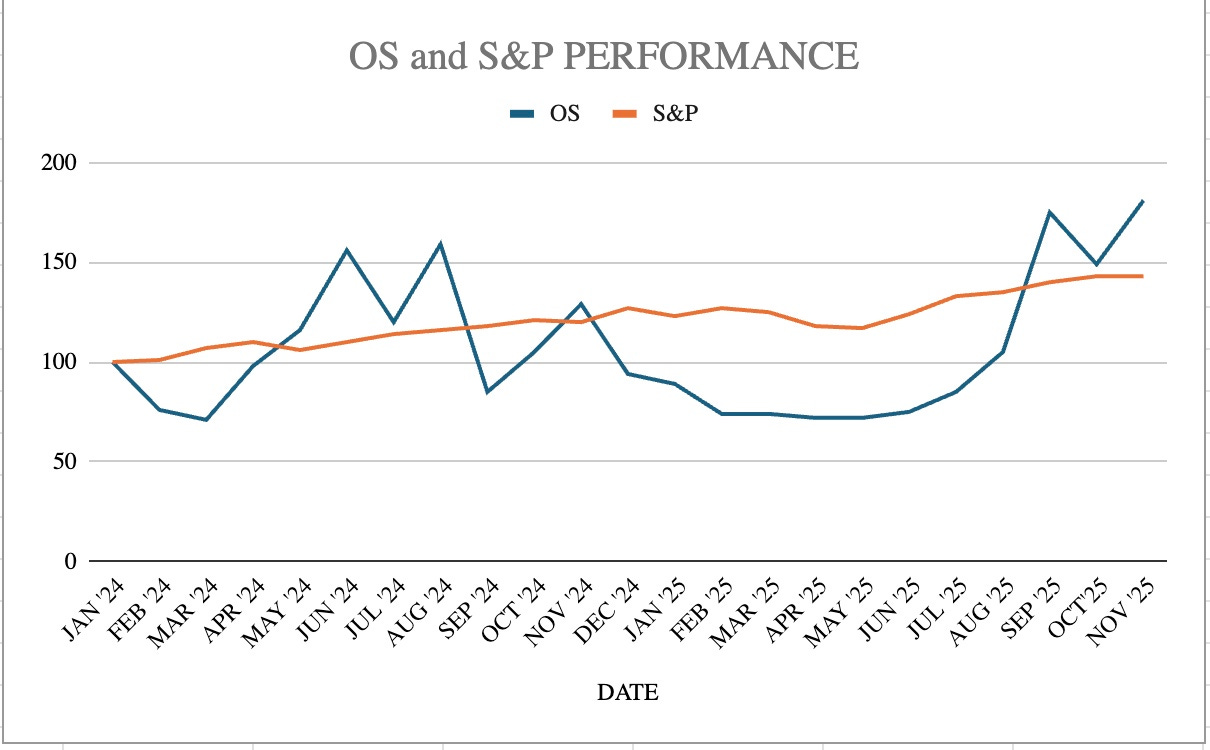

THEREFORE, WE STILL PITCH BUYING SILVER MINERS…..but with a switch in