SILVER AT YEAR'S END

SILVER’S YEAR

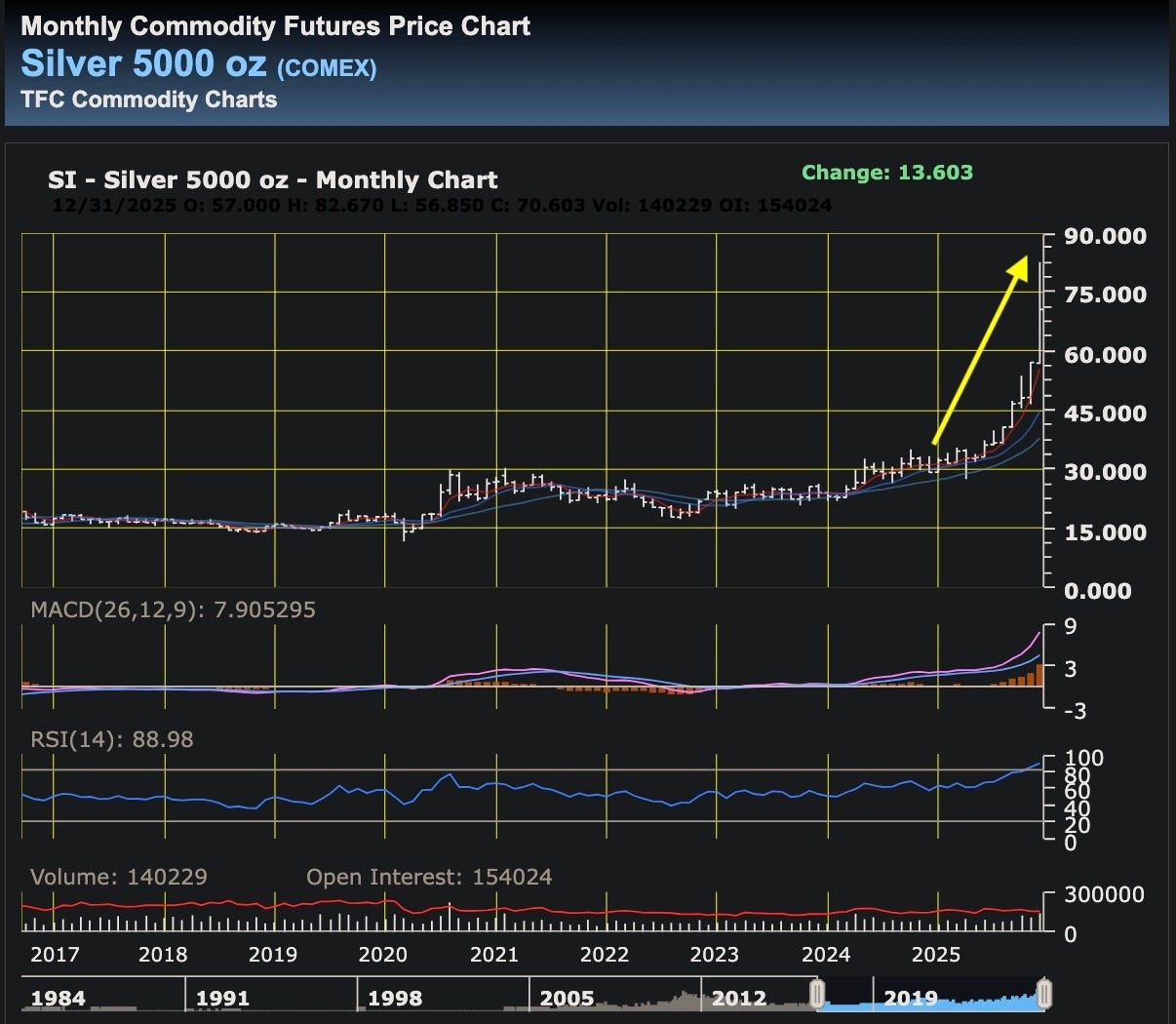

Silver had a dramatic 2025 and a particular dramatic December:

(LINK to Silver Chart 2025: https://futures.tradingcharts.com/chart/SV/M)

Now that we enter 2026, I hope that the market focus will turn to the earnings for Q1 of 2026 to be reported in April or May. The surge in the gold price and significantly more dramatic surge in silver prices should cause a massive increase in earnings.

In addition to the bullish factors pushing silver up which include:

A multi-year deficit in the supply of silver from the mines to demand

The severe shortages of silver inventories in the future exchanges (like COMEX)

The canted lowering the number of ounces of silver needed to buy an ounce of gold from the current @60 to a range of 15 to 30

The growing investment demand from American investors as silver joins gold as a monetary asset class

And new bullish factors keep coming such as China’s restriction on exporting silver and the massive demand from India (45 Million ounces in October alone).

Michael Oliver, whose predictions for silver prices have been accurate, predicts an additional major surge in the first half of 2026 from the current $70 per ounce to $200 or more:

Over on the fundamental outlook on silver, check out this 20 minute video with comments from Andy Schectman and Alasdair Macleod:

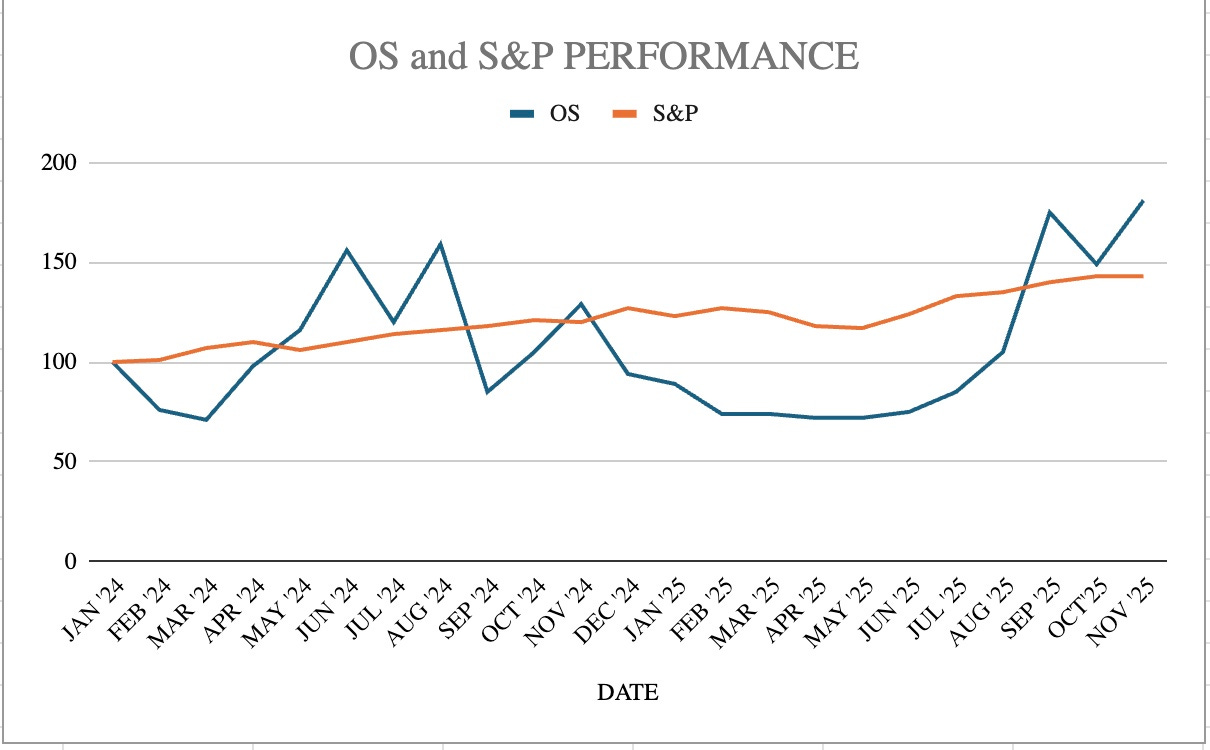

We continue to be comfy re the outlook for silver and continue STRONG BUYS for the silver miners: