STICK WITH SILVER

NOTE ON THE O.S. CHART: The Occasional Speculator’s updated performance chart, unlike many investment newsletters, is based on our actual portfolio. We have historically suffered considerable volatility in our results relative to the market because of our unique speculative approach. Thus we have undergone a considerable period where we under-performed versus the overall market (i.e. the S&P). In 2025 our focus on the silver miners is primarily responsible for the improvement in performance (as you can see) since spring. You can see this both in terms of growth in dollar value as well as regaining out-performance of the market since the beginning of 2024. Those readers interested in more information about the chart can ask me directly in the Comments section.

AS THE SILVER CORRECTION IS BOTTOMING, BUY THOSE SILVER MINERS

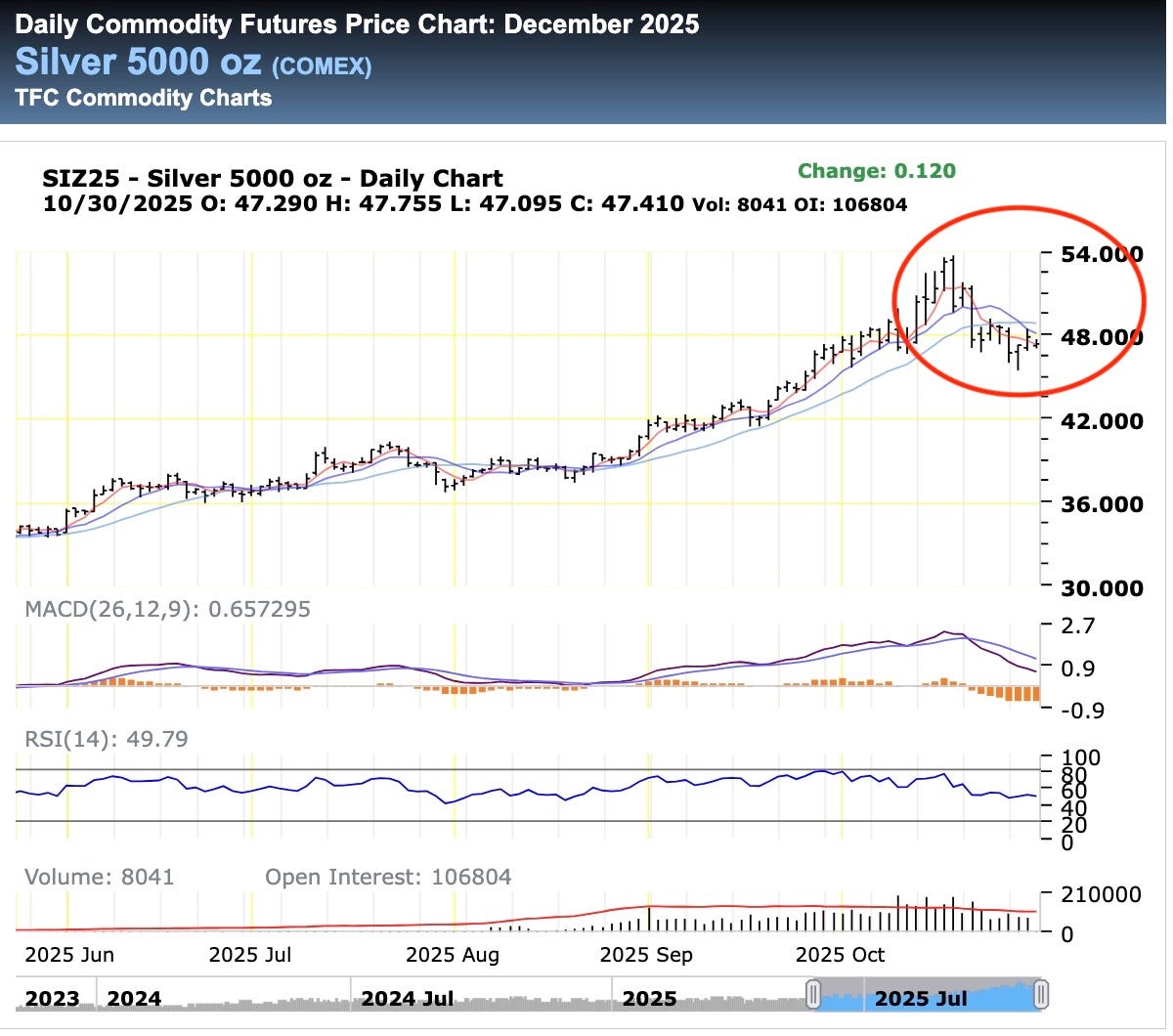

Silver, for the past couple weeks, has experienced a significant drop in price from $53 to $45:

LINK Silver Chart: https://futures.tradingcharts.com/chart/SV

This drop coincided with very bullish fundamental info on a major shortage of physical silver that could imperil those who chose to be short huge amounts of paper silver futures contracts. The enormous recent selling was triggered by the bullion banks (like JP Morgan, Bank of America, etc…) who, when short in the past, have used such manipulations to scare owners of long paper futures to panic and sell (often via sell stop orders).

BUT

The demand for physical silver continues, as does the potential of a major short squeeze.

Today’s Fed Chairman Powell’s rate cut impacted the bond market and the Bitcoin market negatively. But important silver analysts think today’s Fed rate cut could contribute to a rebound in the price of silver. See below:

Peter Schiff

and ‘Bald Guy Money’

A couple more articles re the silver shortage:

Andy Schectman’s focus on how the LBMA is concerned about silver prices - high lease rates:

ZeroHedge with more info on the silver shortage:

Link to ZeroHedge article: https://www.zerohedge.com/news/2025-10-29/silver-lease-rate-fall-elephant-remains

Therefore we continue to advise that this correction in gold and silver prices should be used to buy silver miners. :

STRONG BUY on CDE @$18.25; STRONG BUY on EXK @$8.08; STRONG BUY on GSVRF @$0.25; STRONG BUY on SCZMF @$1.43

HALLADOR - ENERGY TO DATA CENTERS AVAILABLE NOW

For the past 18 months I have learned from the great newsletter, Grant’s Interest Rate Observer, that on Jan 1, 2026 the earning power of Hallador Energy will surge big time - at least to a $2-3 per share range from an estimated $0.54 for 2025. WOW!

So I have, on balance, been supportive of the stock but was nervous to get too excited since if the stock market were to take a hit, like in 2000 (where NASDAQ dropped 80%), then HNRG-with current puny earnings-would drop. Such a DILEMMA…

BUT…

The stock market never broke. Meanwhile HNRG stock, in the $5-7 range in early 2024, has surged big time to today’s price of $20.54!

Meanwhile recent reports from the company verify the 2026 earnings surge coming when the company’s electricity power station business benefits from dramatically higher prices for its power, in return for getting low priced power through 2025.

The three reports (below) explain the company’s bullish 2026 outlook. I hold to my estimate of 2026 earnings in the range of $2-3 per share (which I derive from the Grant’s coverage). Note that those earnings should show considerable growth in the years after 2026 because HNRG’s power - being coal fired - is reliable baseline power which commands a higher price to its customers, including A.I. data centers throughout the whole midwest power grid that HNRG connects to directly.

Keep reading with a 7-day free trial

Subscribe to The Occasional Speculator to keep reading this post and get 7 days of free access to the full post archives.