URGENT: Aspen Group Has Nursed back to Health- AND BOY IS IT CHEAP!

This Could Be A HOMERUN...Right Under Your Nose!

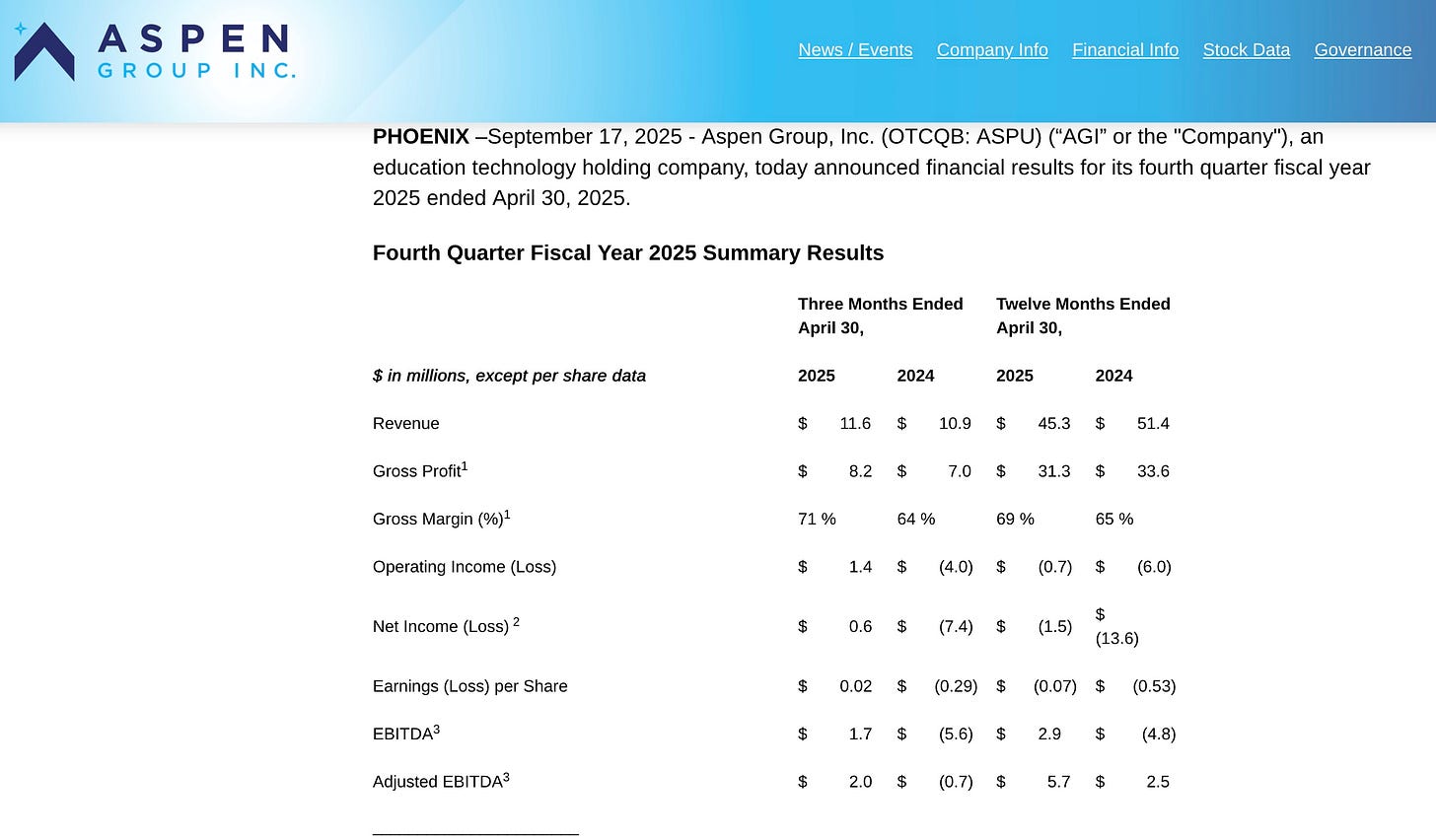

I present (the actual) Aspen Group Q4 Results:

ASPEN GROUP (ASPU @ 10 cents)- the education technology company (focused on online graduate degrees for nursing) reports return to profitability - here are the highlights:

Aspen Group Delivers Positive Net Income in Fourth Quarter Fiscal 2025:

Q4 Fiscal 2025 Highlights (compared to Q4 Fiscal year 2024)

Net income of $0.6 million and positive operating cash flow of $0.6 million

Total revenue growth of 6% to $11.6 million

Lowered operating expense by $4.7 million to deliver operating income of $1.4 million

Delivers positive Adjusted EBITDA of $2.0 million as compared to ($0.7) million

Restructuring and efficiency gains are expected to drive positive operating cash flow in FY 2026

How cheap is cheap? The market cap is tiny - a mere $2.9 Million - while stock holders equity is - wait for it - $30 Million and net income for Q4 alone is $600K and Q4 revenues are $11.6 Million - WOW! & WOW!

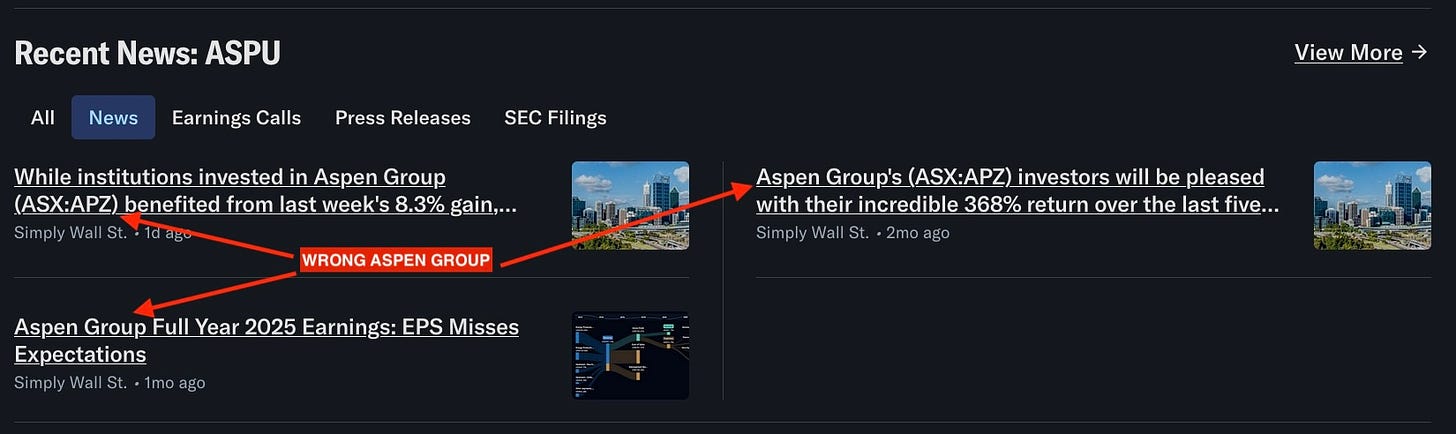

The stock remains unusually cheap in part because Yahoo Finance did not print the ASPU press release on their Aspen Group website, but instead published, a month ago, the press release for a DIFFERENT Aspen Group (‘ASX’ rather than our baby ASPU…(sigh)). LOOK below at the screenshot on “Yahoo Finance NEWS”:

In addition ASPU is super cheap because the stock is not in the full NASDAQ exchange so research coverage is negligible and liquidity (average daily volume is only 38K shares). We could very well be looking at the greatest report omission of all time…and a golden opportunity hiding in plain sight!

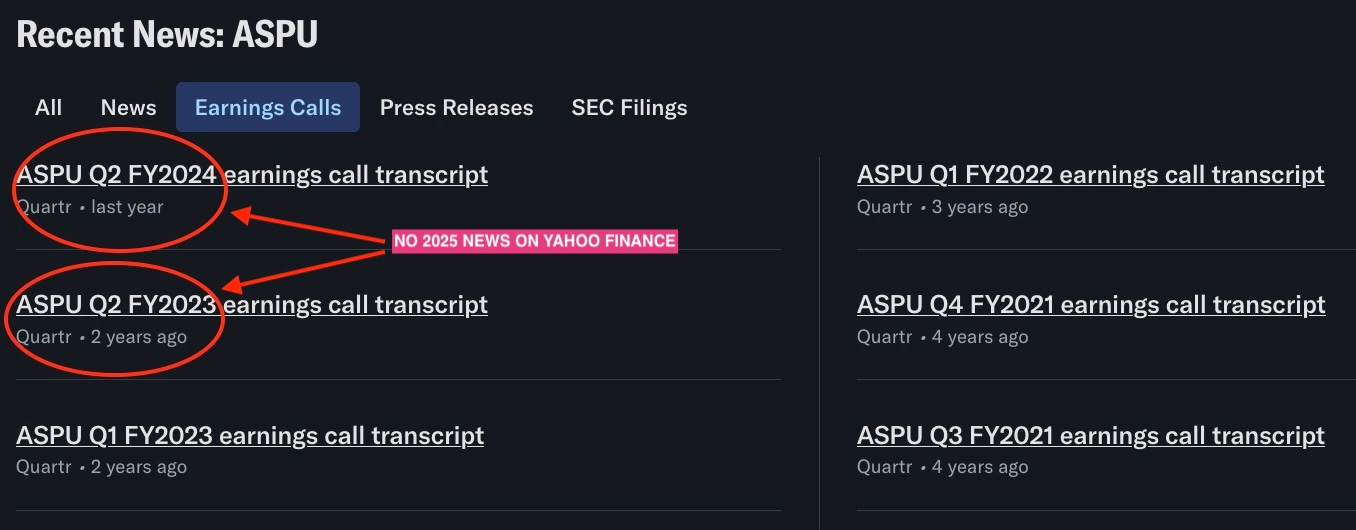

LOOK, no news at all for 2025 despite the company publishing it’s stellar Q4 2025 earnings report on Sept 17, 2025. (screenshot taken today Sept 29, 2025):

Here is our severely undervalued stock hiding in plain sight:

LINK to Aspen Group on Yahoo Finance

We recommend reading the ASPU report in full. But as a teaser, repeat the comments from the CEO which predict further progress in the coming year. Michael Mathews, Chairman and CEO of AGI, stated:

“We ended FY2025 with strong momentum, delivering positive net income and cash flow in the fourth quarter. Growth in organic enrollments and tuition increases in our Family Nurse Practitioner program drove a higher gross margin at USU, while disciplined instructional spending and the full benefit of prior cost restructurings lifted AGI’s overall gross margin. These improvements resulted in a 12% operating margin and our first quarterly profit. For the full year, we significantly narrowed our net loss to $1.5 million, down from $13.6 million in FY 2024. Managing cash remains a top priority, and we expect the continued benefits of our restructurings and efficiency initiatives to generate positive operating cash flow in Fiscal 2026. This will allow us to resume marketing spend at the right level to support the enrollment growth. Our progress reflects not only the strength of our operational model, but also the positive impact of our strategic enhancements on the business over the past year.”